Home of the $500 Down

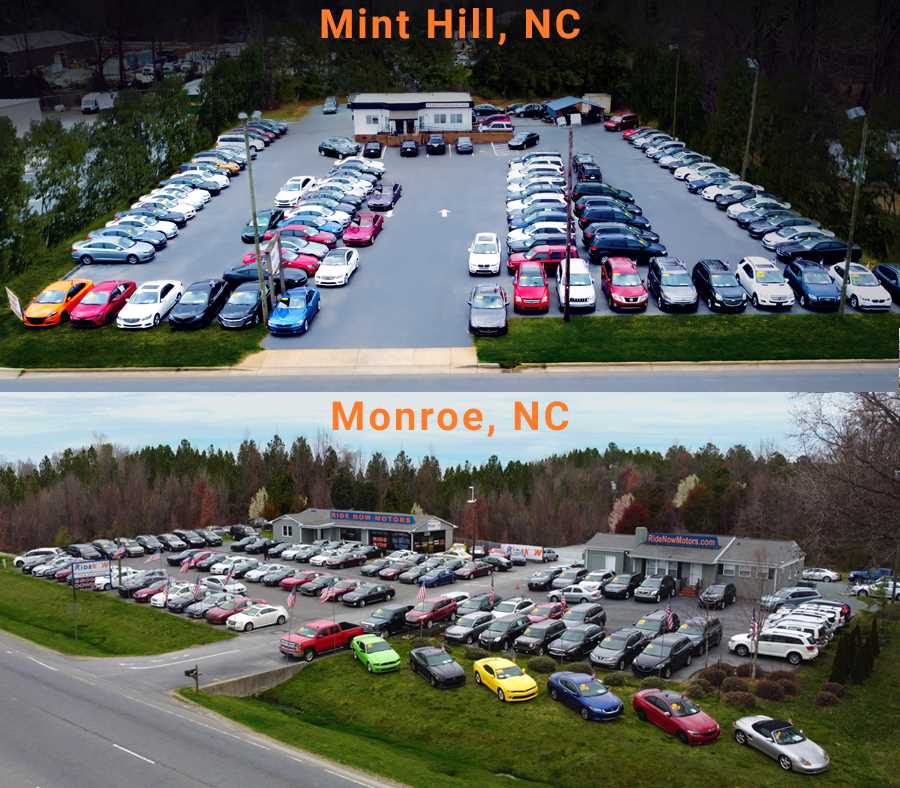

Ride Now Motors is a Charlotte metro used car dealership.

We buy, sell, and trade quality used cars. At Ride Now Motors our financing programs can get you behind the wheel of a used car, truck, or SUV - even if you have

no credit, bad credit, bankruptcy, collections, or any other derogatory credit. We specialize in the best way to get Charlotte, NC drivers with bad credit into a new set of wheels, fast. Call today and ask about our various financing options.

Do you live in Charlotte, Monroe, Mint Hill, Concord, Stallings, Indian Trail, Matthews, Rock Hill or anywhere else in NC/SC? Are you credit challenged and looking for an excellent dealership to help you find a dependable vehicle? Our goal is to get you the used car and financing you deserve. We know that finding the best used car can be tiresome, and difficult. So, we accept all credit applications, and often times can collect important information over the phone to expedite the car buying process.

Shop hundreds of used cars for sale in Charlotte and Monroe. Browse our large selection of affordable cars under $15,000.